Theft by Inflation

The Sinful Manipulation of Weights & Measures

& Alexander William Salter

Inflation plagues the U.S. economy. According to the U.S. Bureau of Labor Statistics, the Consumer Price Index rose 9.1 percent in June 2022 from a year prior, the sharpest increase in 40 years. This grim picture looks even worse when we focus on specific sectors. Food prices rose 10.1 percent, and energy prices a whopping 34.6 percent, over the year. The price of gasoline in June averaged more than $5.00 per gallon for the first time. In some urban areas, regular unleaded topped $8.00 per gallon. That means filling up cars with normal-sized tanks can cost $100 or more.

There’s no way to sugarcoat it: American families are having their budgets squeezed. Wages are rising, but significantly less than inflation. According to the Economic Policy Institute, compensation increased about 5 percent, over the year, which means that despite rising wages, workers are losing purchasing power overall. The difficulties are particularly severe for households of limited means. When the necessities of life get more expensive, families living on $50,000 a year are harmed more than families making $100,000 per year. A given price increase eats up a larger share of the former’s budget. We should never lose sight of the human costs of inflation, especially for the economically disadvantaged.

We know that too much money chasing too few goods causes inflation. Policy-wise, we might not be able to do anything about the “too few goods” part. But the “too much money” part is a straightforward consequence of excessively loose monetary policy. Now economists and policymakers are in a difficult spot, trying to ease inflationary pressures without upsetting markets. While we wish them well, we worry that the moral—and specifically the theological—aspects of a weakening dollar will get drowned out by policy wonkery.

How should Christians think about inflation? What does it mean for central bankers to be faithful stewards of citizens’ purchasing power? After reviewing some biblical and theological foundations for a Christian ethic of monetary policy, we will augment that framework by exploring the effects of contemporary monetary policy, focusing on the “least of these” among us (cf. Matt. 25:31–46).

What Does the Bible Say?

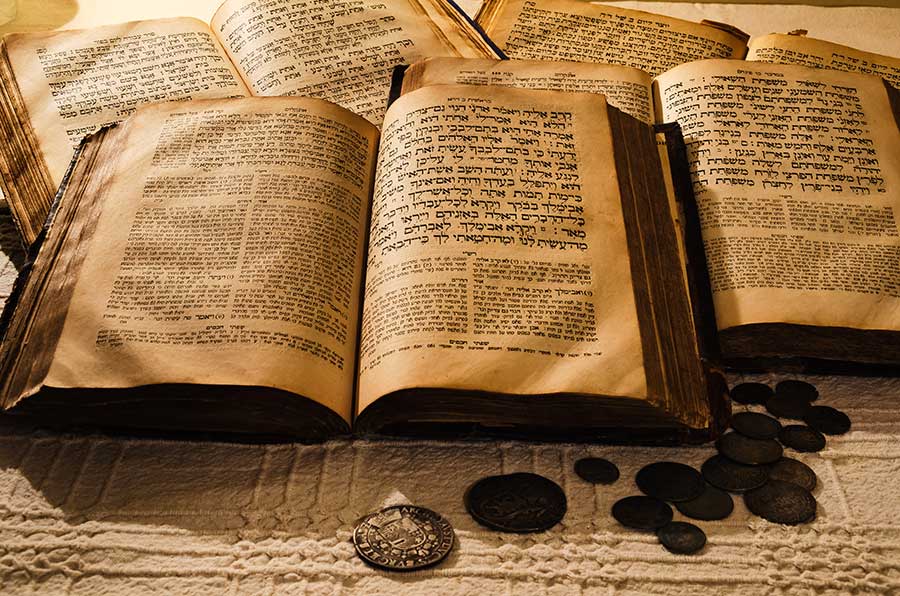

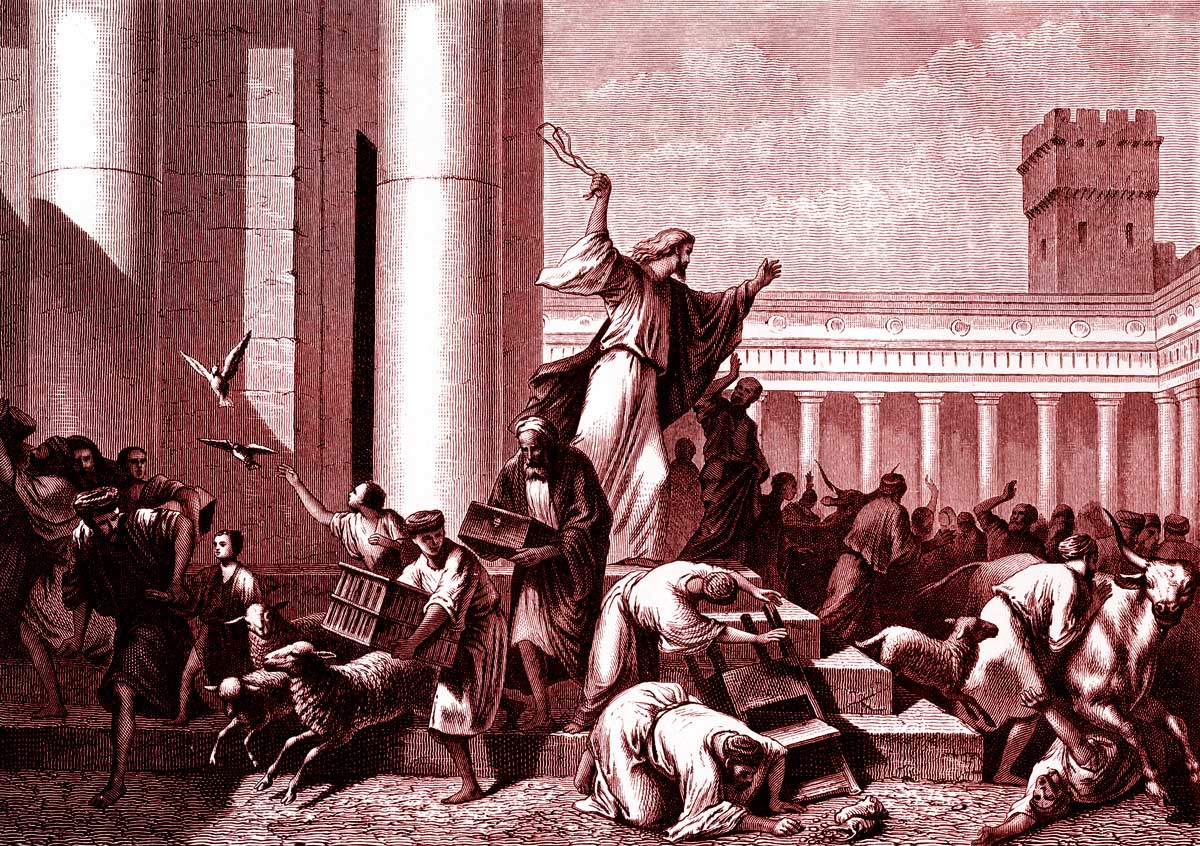

Perhaps surprisingly, the Bible has plenty to say about monetary policy. Between Exodus, Leviticus, and Numbers, there are 25 references to “the shekel of the sanctuary.” The Lord instructed Israel, as part of the Law of his covenant with them, to have a standard of weight—“twenty gerahs,” according to Exodus 30:13—for their currency in order to assure its consistent value. A shekel of this weight was kept in the tabernacle to ensure against transactions involving debased or counterfeit currency.

Why is this important? First of all, it is dishonest to tell someone you will pay him a certain amount but then to disguise the fact that you are really paying him less. Second, paying one’s debts in currency you’ve depreciated is a form of theft and therefore an injustice. As the Lord tells Israel, “You shall do no injustice in judgment, in measurement of length, weight, or volume” (Lev. 19:35). So also, “Diverse weights and diverse measures, / They are both alike, an abomination to the Lord” (Prov. 20:10). Without a stable currency, commercial justice—perhaps even commerce itself—becomes impossible. By contrast, the Lord promises blessings to Israel if the people maintain monetary discipline: “You shall have a perfect and just weight, a perfect and just measure, that your days may be lengthened in the land which the Lord your God is giving you” (Deut. 25:15). As we will see, having a reliable medium of exchange is also a necessary and natural component for any economy to flourish according to modern economics.

One last biblical image is soteriological: that of the refiner’s fire (see Zech. 13:9; Mal. 3:2; Rev. 3:18) by which the purity of gold was tested and proved. This image uses the economic idea of a reliable currency as a metaphor for our salvation. As gold is tested by the refiner’s fire, the fire of God’s judgment purges away our sin in the present—or else in the age to come. There is no escaping Christ’s fearsome judgment seat.

What Does Christian Theology Say?

Christian theologians have a long history of advocating for responsible monetary policy. Their teachings, rooted in Scripture, apply timeless principles to new economic and political circumstances.

Dylan Pahman is a research fellow at the Acton Institute for the Study of Religion & Liberty, where he serves as executive editor of the Journal of Markets & Morality. He is the author of Foundations of a Free & Virtuous Society (Acton Institute, 2017).

Alexander William Salter is the Georgie G. Snyder Associate Professor of Economics in the Rawls College of Business at Texas Tech University, a research fellow at TTU’s Free Market Institute, a senior fellow with the American Institute for Economic Research’s Sound Money Project, and a senior contributor with Young Voices. He is coauthor, with Peter J. Boettke and Daniel J. Smith, of Money and the Rule of Law: Generality and Predictability in Monetary Institutions (Cambridge University Press, 2021).

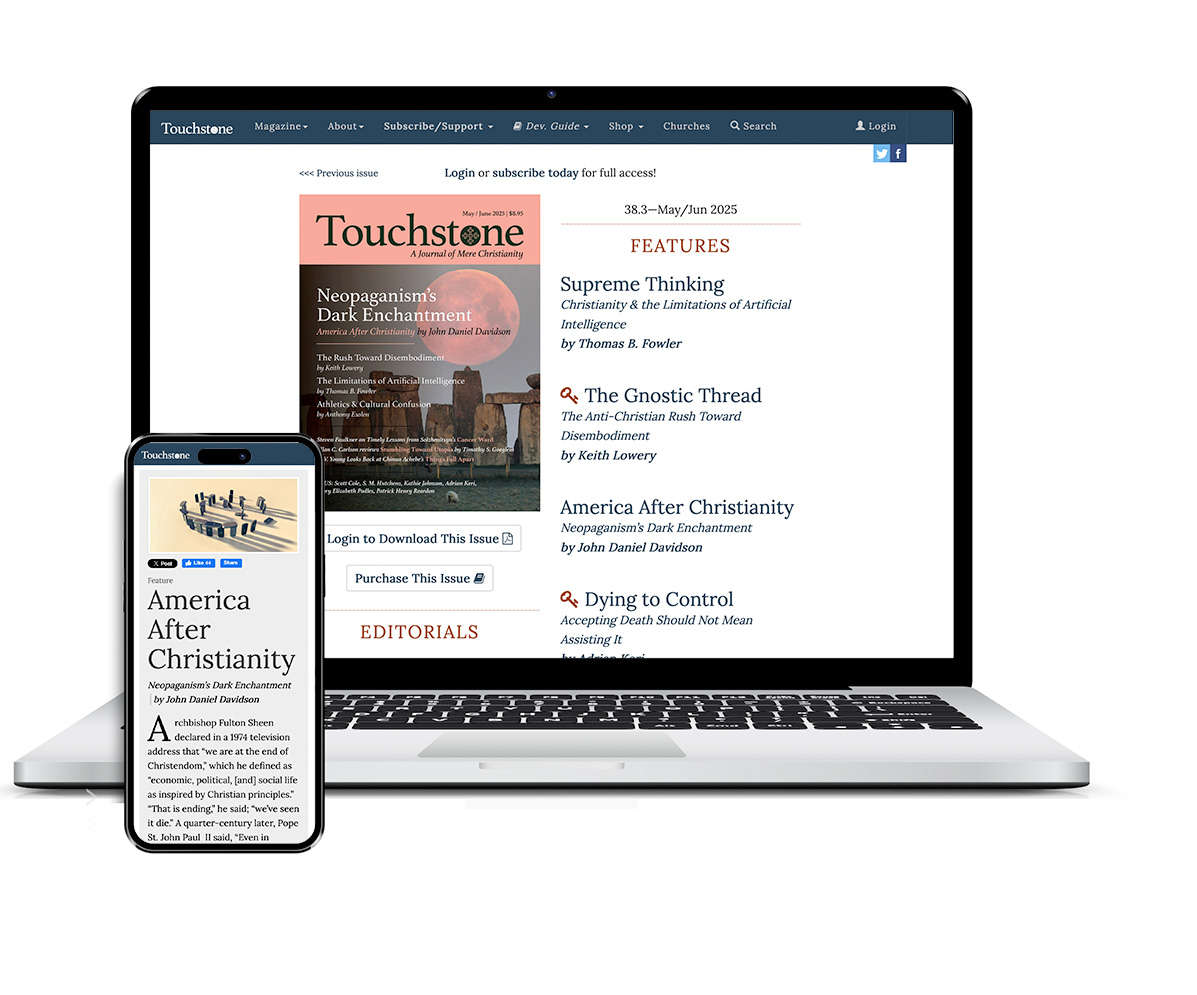

subscription options

Order

Print/Online Subscription

Get six issues (one year) of Touchstone PLUS full online access including pdf downloads for only $39.95. That's only $3.34 per month!

Order

Online Only

Subscription

Get a one-year full-access subscription to the Touchstone online archives for only $19.95. That's only $1.66 per month!

bulk subscriptions

Order Touchstone subscriptions in bulk and save $10 per sub! Each subscription includes 6 issues of Touchstone plus full online access to touchstonemag.com—including archives, videos, and pdf downloads of recent issues for only $29.95 each! Great for churches or study groups.

Transactions will be processed on a secure server.

more on Christianity from the online archives

8.4—Fall 1995

The Demise of Biblical Preaching

Distortions of the Gospel and its Recovery by Donald G. Bloesch

more from the online archives

calling all readers

Please Donate

"There are magazines worth reading but few worth saving . . . Touchstone is just such a magazine."

—Alice von Hildebrand

"Here we do not concede one square millimeter of territory to falsehood, folly, contemporary sentimentality, or fashion. We speak the truth, and let God be our judge. . . . Touchstone is the one committedly Christian conservative journal."

—Anthony Esolen, Touchstone senior editor